Welcome to Taxation Portal

A tool for hassle-free tax filing

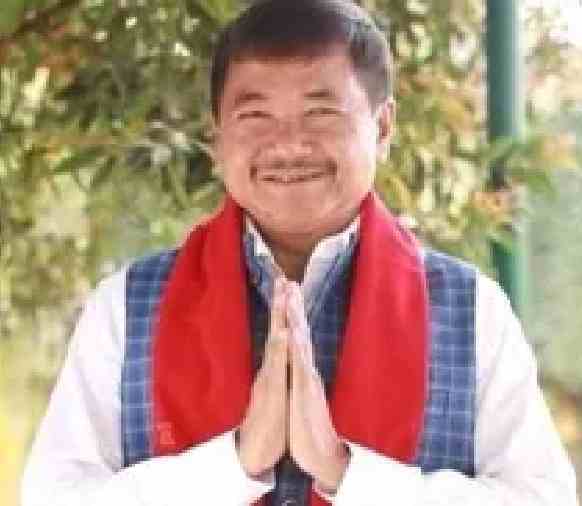

Hon'ble CEM of KAAC

Dr. Tuliram Ronghang

Taxes are a significant source of money for the government, enabling it to provide residents with necessary public services. These services include education, healthcare, infrastructure, and initiatives for social welfare. Without taxes, the government would be unable to offer these services, which would be detrimental to society as a whole. Taxes serve a crucial role in fostering economic growth, maintaining fairness, and rewarding specific behaviours, in addition to generating income. Hence, the KAAC will implement tax reform and digitization so that new development projects can be undertaken for the residents of the KAAC region. I hope these adjustments are positively received by the public. Through this platform, citizens can easily obtain numerous tax-related services.

Process of Application

1. Register

Whoever desires to conduct any commercial activity in the KAAC region must register on this portal. Navigate to the Register section, complete the registration form, and create an account.

2. Apply for Licence

Apply for any service, such as an application for a Business License, Professional Tax, or Contractor application, after completing registration with online fee payment.

3. Upload Documents for Licence

According to the KAAC's application requirements, all documents and forms must be uploaded. Depending on the application type, the required documentation may vary.

4. Make Payment

Once all the required information has been uploaded, please submit your application. For any service to be processed, the application cost must be paid online.

5. Download Acknowledgment and Check Status

Download the application acknowledgement for future reference until you obtain the final certificate from the tax department. The site enables you to monitor the status of your application.

6. Get a Copy of the Certificate

After all of your documentation and verifications have been processed, the Department of Tax will generate your certificate, which you may then obtain from your portal. SMS notification will be sent to you.

Frequently asked questions

If you can't find what you're looking for, email our support team at xyz.example@gmail.com.

What is the Age Limit for application?

Any one with Indian citizenship not less than 18 can apply for the TL and PT

What documents are required to be uploaded?

Applicant must submit the following documents:-

- Recent passport size photograph.

- Rent argument or NOC of building use.

- Previous TL copy.

- Voter ID number.

All other documents will be verified at the appropriate time before final selection. The information provided in the application must be in conformity with the testimonials available with you. In case of false information or hiding of facts, your application will stand cancelled and you may be liable to be prosecuted as per prevailing Acts and Rules.

What is the applicant registration fee?

Applicat must submit the following application fees

- ₹500/- for all category.

The fees must be paid online via payment gateway link in the Portal ONLY.

What is the process of application?

All Applications are to be made in full in prescribed online form ONLY on our Department of Taxation Website. xxxxxxxxxx. Any form found incomplete will be rejected without any further processing.

How will I get my Certificate?

Final certificate for the licence will be available for download from the Department of Taxation Website www.btrrecruitment.com. Applicant will be informed via SMS after the certificate is ready are advised to check the website regularly for updates regarding admit cards & important information.

Can I apply against multiple Trade Licence ?

Yes, you can but, One applicant can apply for his own Licences.

What if my old trade licence document is lost ?

If your old Trade licence is lost you need to apply for a. New application for the portal.

If I do not have AADHAR CARD, can I apply for the post?

'Yes' you can. AADHAR Card is not mandatory for filling up the application.

If I do not have Voter Id Card or if I'm not a resident of KAAC, can I apply for the NOC?

No, you cannot. To get a NOC applicant must mandatorily be residents of KAAC area with Valid proof.

What is the minimum educational qualification required to apply?

There is no minimum educational qualification required to apply.

How can I check my status of application?

Applicant can check their application status form the portal.